June 22, 2020 – While this unprecedented pandemic is affecting everyone around the world, it is taking the heaviest toll on those who have been poor and vulnerable all along: informal micro-entrepreneurs and small farmers, the target group of the ECLOF network. Those who live at or below the poverty line face an erosion of their ability to make a living coupled with no or limited access to government relief programs. Often without emergency savings or insurance, this leaves them even more vulnerable to shocks.

The crisis is also testing the resilience of ECLOF’s member institutions. Staff work from home, loan officers cannot travel and ECLOF solidarity groups cannot meet. Movement restrictions, states of emergency, partial or complete lock-downs and government-imposed repayment moratoria impact loan collections and disbursements throughout the ECLOF network.

ECLOF International works closely with its network members to address the challenge. By offering guidance and where necessary lenience on repayments, by sourcing grant funds for protecting staff and clients. On the ground, ECLOF member MFIs take a variety of immediate measures to support their clients: offering loan moratorium, rescheduling or renewal; distributing protective gear, training on sanitary measures and channeling information about state or other relief efforts to clients. In some places the strong rural exposure of ECLOF has helped where farmers keep producing and selling or rural economies are “un-locked” first.

It is clear that the financial inclusion sector will never be the same after this crisis. To serve their clients more securely and effectively, ECLOF members have started ramping up digital financial services by developing strategies for digital transformation, testing new digital channels and introducing “all-digital” loan processes.

ECLOF’s work continues to rebuild faith and resilience among our clients and their communities—throughout and beyond this crisis.

Gallery:

- ECLOF Myanmar: Raising awareness of appropriate sanitary measures

- ECLOF Colombia: Distributing Covid-educational material to rural clients

- ECLOF Ecuador: Training farmers on market re-entry strategies post lock-down

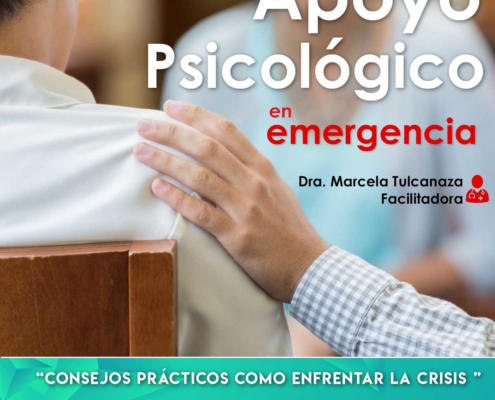

- ECLOF Ecuador: Offering clients a free hotline to call for psychological advice

- ECLOF Armenia: Protecting clients and staff with face shields